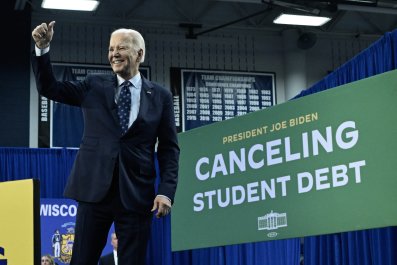

The Biden administration has extended the deadline for student loan borrowers to apply for a loan consolidation.

With the rising costs of higher education, more students are turning to loans to finance their degrees. However, many students struggle to repay these loans after college, which has become a significant issue for Democrats. So far, President Joe Biden's administration has approved nearly $160 billion in student loan forgiveness for almost 4.6 million borrowers, according to the U.S. Department of Education (DOE).

Read more: Federal PLUS Student Loans 2024 Review

Student loan borrowers can consolidate, or combine, one or more federal education loans into a new Direct Consolidation Loan, which helps them gain access to federal forgiveness programs, among other benefits.

Initially, the deadline to apply was April 30, but now borrowers have until June 30 to request the loan consolidation.

By consolidating their loans, borrowers can get a payment count adjustment, which gives them credit for past loan periods that previously wouldn't have counted toward loan forgiveness under income-driven repayment (IDR) plans or Public Service Loan Forgiveness (PSLF).

Direct Loans or Federal Family Education Loan (FFEL) Program loans held by the DOE "will see a full and accurate count of their progress toward loan forgiveness" in September 2024, according to a press release from the DOE on Wednesday.

"Because of this updated timeline, borrowers with non-federally held FFEL loans who apply to consolidate by June 30 can still benefit from the payment count adjustment," the release said.

Read more: When Is the FAFSA Deadline?

U.S. Under Secretary of Education James Kvaal said in the release, "The Department is working swiftly to ensure borrowers get credit for every month they've rightfully earned toward forgiveness. FFEL borrowers should consolidate as soon as possible in order to receive this benefit that has already provided forgiveness to nearly 1 million borrowers."

Newsweek reached out to the White House via email for comment.

How do I Apply for Loan Consolidation?

According to the Federal Student Aid website, it takes less than 30 minutes to apply for a direct consolidation loan online. There is also an option to submit an application via mail.

If you decide to apply online, go to studentaid.gov/loan-consolidation. You will have to confirm your personal information, select your loan servicer and which loans you want to consolidate, choose a repayment plan, confirm your references and add any new references you have, agree to the terms and conditions of the loan consolidation, and then review the information you have provided before signing and submitting your application.

You will need a verified FSA ID; personal details such as your mailing address, telephone number, and email address; financial information and additional loan information to complete the application.

After submitting your application, a loan servicer will manage the consolidation process in which they will be your point of contact for any questions you may have.

Disclaimer: The copyright of this article belongs to the original author. Reposting this article is solely for the purpose of information dissemination and does not constitute any investment advice. If there is any infringement, please contact us immediately. We will make corrections or deletions as necessary. Thank you.