California will add a financial literacy course to its high school graduation requirements after Gov. Gavin Newsom signed a bill into law June 29, following an agreement with an advocacy group that had collected enough signatures to take the issue to voters.

Californians for Financial Education, a group founded by businessman Tim Ranzetta, asked state election officials to remove their question from the November general election ballot after lawmakers passed a similar bill last week, an 11th-hour move to beat the withdrawal deadline.

While Ranzetta and other supporters argued students need lessons in concepts like the tax system and credit to succeed in life, some skeptics said the unusual step of setting classroom requirements through the popular vote could set a bad precedent and open schools up to more intrusive and divisive mandates.

That debate became moot after Newsom signed the bill.

“We need to help Californians prepare for their financial futures as early as possible” Newsom said in a statement. “Saving for the future, making investments, and spending wisely are lifelong skills that young adults need to learn before they start their careers, not after.”

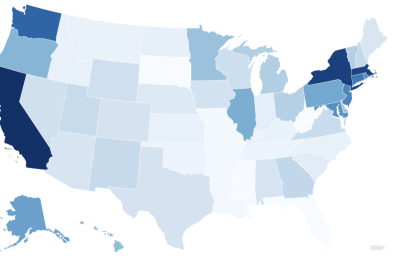

The new mandate makes California the 26th state to pass a financial literacy course requirement, though some are not fully implemented, according to the Center for Financial Literacy at Champlain College. The law requires high schools to offer a standalone, semester-long personal finance education course by the 2027-28 school year, a year later than the ballot issue supporters proposed. The course will become a requirement for the 2030-31 graduating class.

“We look forward to supporting the implementation of this essential course,” Ranzetta said in a statement, commending lawmakers for reaching an agreement on the legislation.

To address concerns that it would be difficult for schools to accommodate another state course requirement, lawmakers amended the original bill to allow students who complete the finance course to opt out of a separate economics requirement.

Placing a single high school course requirement on a ballot would be an unusual step, Amy Farley, an associate professor of educational leadership and policy studies at the University of Cincinnati who has studied the history of education-related ballot measures, told Education Week in May.

Farley analyzed 282 education-related ballot questions states considered from 1902-2012 for a 2019 study and found none that mandated a course. Putting such an issue on the ballot could open the door for future proposals that crowd out needed courses or lead to less popular requirements related to hot-button issues like sex education, Farley said.

“We should all be concerned about the precedent of citizen-led initiatives mandating curriculum,” she told Education Week in May.

Ranzetta, who spent about $7.5 million of his own money to support the initiative, became passionate about financial literacy 13 years ago when he volunteered to teach a personal finance course at a high school in East Palo Alto, Calif., where most college hopefuls would be the first in their families to earn a degree.

“I saw the ripple effects first hand,” he told Education Week in May. “You can’t unsee it. You walk away wondering why every student doesn’t learn this content.”

Disclaimer: The copyright of this article belongs to the original author. Reposting this article is solely for the purpose of information dissemination and does not constitute any investment advice. If there is any infringement, please contact us immediately. We will make corrections or deletions as necessary. Thank you.